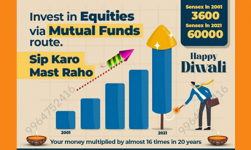

Covid 2nd wave hits market and markets again looks volatile. Sensex drops from 52000 points to 48000. Retail investors are worry that how to manage their equity investments? There is no need to worry by long term investors because this will get over in some times. This situation is similar to what happened during 2020 April and March. Markets crashed almost 30-40%.

Most of the retail investors withdrawn their funds and stopped their SIPs. What happened later months is history. Market recovered almost 60-70% in just 7-8 months.

Below My SIP statement will give you the all details.

Check the above image data, Investors who continued their sips 2020 march-April month their sips value almost 90-100% returns in just a one year. Check the NAV value and Absolute returns marked columns.

Buy more units when the market is low. You will get more Number of units. If possible invest some additional lump sum when the market falls. Experts advise you to not to stop SIP at the time of market volatility. It’s a time to increase sips and invest additional purchase.

Invest for your goals and I am sure you will reach your goals. Before starting a SIP plan for your emergency fund. Investors will do some mistake that small mistake can erase his All financial goals. People withdraw or stop their long term SIPs because of their emergency need. People invest for their kid’s Higher education, marriage and their own retirement but they withdraw to pay hospital bills, buying a car, mobile phone, site, flat etc.

Keep the separate funds for the short term goals, don’t exit from long term goals, you will lose the power of compounding.

This pandemic teaches a lesson to everyone, retirement planning is a must for each and everyone. Create a retirement income through mutual funds investments via SWP route.

Corrections are temporary but growth is permanent.

I wish you good luck for you all. Any questions or queries always feel free to ask me or send ma a WhatsApp message.

Mutual funds subject to market risk, read offer related documents carefully or contact your financial advisor.

Best regards

SRINIVASA M

MFD

Mob: 9964752416/9663890162

www.sipinsure.com