Now a day Financial Freedom is a word or term using by everyone. Due to so many treasons today everyone thinks to achieve the financial freedom and settle in life. This independence day we will learn how to achieve the financial freedom and let us take a oath to achieve this in next 10-15 years.

The first Step to achieve financial freedom is, identify your goals and recourses.

WHAT IS FINANCIAL FREEDOM?

Financial freedom is having enough income to cover your living expenses. It is not about being rich and having tons of money, but having enough to cover your expenses so that you can spend your precious time doing what you like rather than doing things just to earn money. This can be achieved only when you are prepared for it. All you need is a little financial planning, time and patience.

“There is No short cut to become a RICH”

There are so many aspects we need to plan to get financially free, but I have mentioned a top 3 steps to achieve financial freedom.

1) LIVE A DEBT-FREE LIFE

The biggest obstacle and enemy for financial freedom is debt, people paying 18-36% interest rates for credit card loans and personal loans. People buy luxury things in early age with initial stage of earnings and fall on debt trap and they pay hefty EMI for 5-10 years and they spoil their savings and investments surplus. They lose the power of compounding and they start very late to invest and take much time to create big corpus to retire, kids education and family future needs etc.

“TIME IS MORE VALUABLE THEN MONEY, YOU CAN GET MORE MONEY BUT YOU CANNOT GET MORE TIME” Truth is that Money Multiply with power compounding with time.

2) PREPARE FOR LIFE UNCERTANITIES AND PROTECT IT FULLY

One thing that can derail your aim of financial freedom is unseen expenses. So being ready for it is the key. There are two things to do.

- Build a contingency fund: This fund is created to meet urgent or unforeseen expenses. Suppose, you have already set your budget for a month and kept a certain amount as savings. At least three to six months’ expenses should be put away as a contingency fund. This ensures you don’t need to dip into your investments in case of an emergency.

- Get medical insurance: Rising healthcare costs and no health insurance means one medical emergency can set your goal to become financially free back by years. So to ensure your investments are not wasted in paying medical bills, get health insurance. Remember lakhs of families fall from upper class to poor due to unexpected medical expenses. People sold their valuable assets to get treatments by paying hospital bills.

- Get an adequate life insurance cover: “Life Insurance is a one of the essential product, not a luxury product” Calculate your Life value and secure it fully. 10 times of your annual income as a Life insurance cover is Must. Don’t compromise with this at any cost. Secure your family and dependents future.

IDENTIFY YOUR GOALS AND INVEST TO REACH YOUR GOALS WITH GOAL BASED PLANNING

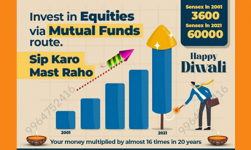

Start investments as early as possible, even if it is in small amounts, and let the power of compounding show its magic. Again having a goal-based approach helps you determine how much money should go towards each investment while you are creating your monthly budget. This can save you from unnecessary financial stress and save you tons of money. Let’s illustrate this with an example.

22-year-old Amit is a techie by profession but his passion lies in photography. He wants to plan well and retire by 45 and switch professions. But, before that, he wants to ensure that he has enough financial back up to pursue a second career at the age of 45. Now, considering the inflation rate, years of expectancy post-retirement and monthly expenses (now and then), he has to calculate his retirement corpus. And in the next step, he has to calculate how much money he has to save every month to create that corpus in the given timeframe.

Let’s say he figures out he will need Rs 2 crore before he can make the switch. Here is how much he will need to invest if he starts now compared to if he waits a few years, assuming 12 percent average annual returns.

As you can see, starting early means one has to put a small amount to achieve a goal and this makes it easier to get started.

CONCLUSION: To achieve financial freedom we need to follow discipline in investing and maintain the stable earnings. Keep yourself updated and learn new skills and increase your income and start living Healthy. Once you identify goals and started working for the same then sure you will reach your goals with given time frame.

I wish this Independence Day will make your financial freedom planning execution and enjoy the rest of your life. Let us start with small and witness for big change in next 10-15 years.

HAPPY INVESTING AND HAPPY INDEPENDENCE DAY IN ADVANCE

Best regards

SRINIVASA.M

AMFI Certified Mutual funds Distributor

Mob: 9964752416

Email: srimuneppa@gmail.com